The biogas

market

Growing momentum across Europe

In Europe

18,000 units producing biogas (including 11,000 in Germany)1

209 TWh of primary biogas energy produced in EU 28 in 20192

Biomethane production accounts for less than 5% of Europe’s natural gas consumption3 and is currently driving the sector’s growth

1Source : European Biogas Association

2Source : Baromètre Biogaz – Eurobserv’er – décembre 2020

3Source : IFP Energies Nouvelles

Biogas production: ranking of European countries4

- Germany

- UK

- Italy

- France

- Czech Republic

4Source : Baromètre Biogaz – Eurobserv’er – décembre 2020

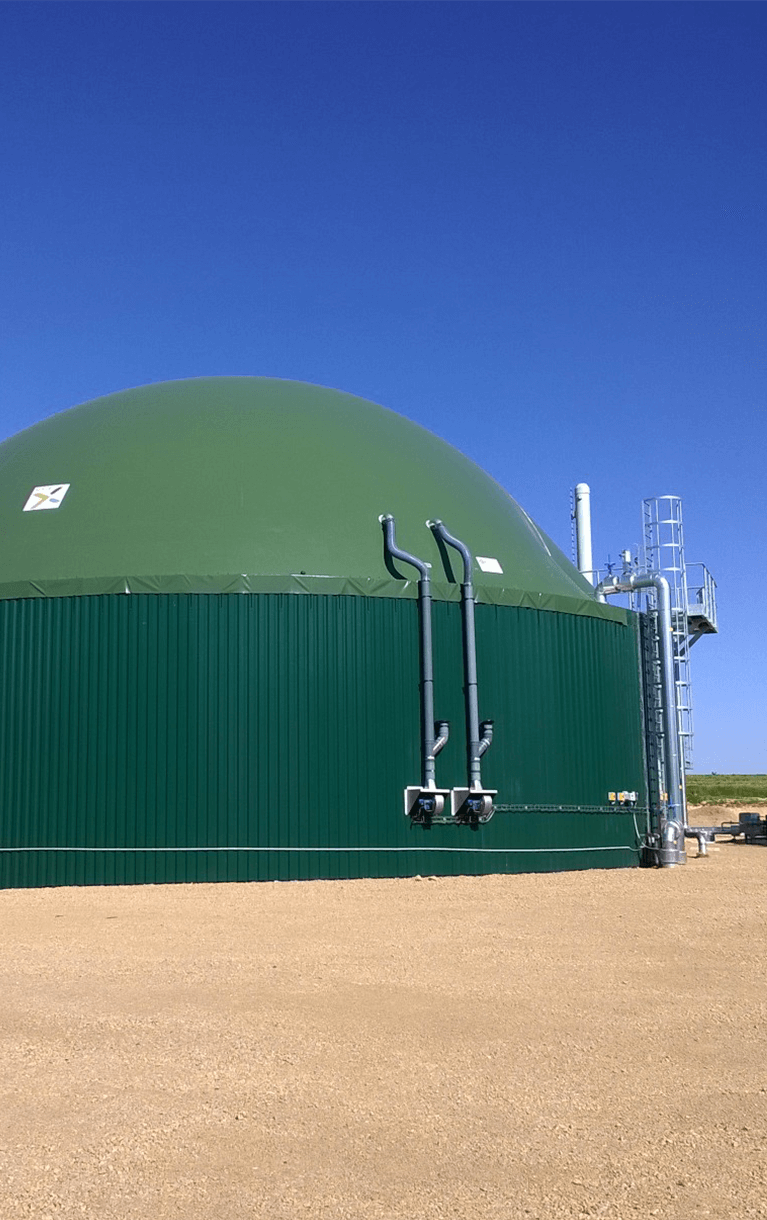

Evergaz operates in 3 European countries: France, Germany and Belgium. View map of Evergaz sites

Evergaz decided to pursue an international development strategy to draw on feedback from more mature biogas markets, such as Germany, and create operational synergies between the sites in operation.

We began our global expansion in 2017 with the acquisition of 2 biogas facilities in Germany, in partnership with Meridiam, and we wish to continue investing in other European countries.

Biogas in France

high-potential market

France has the biggest biogas potential due to its significant farming and food processing activity.

With only 1,000 biogas facilities in 2021, the French market tends to grow, driven by:

The energy companies’ desire to make gas “greener”

Strong political determination to implement the ecological transition in the territories (Lecornu Plan in 2018, earmarking €100 million for anaerobic digestion)

More than €7 billion invested in development projects2

More than 26,000 jobs created2 in the sector looking forward to 2028

1Source : Ministère de la transition écologique et solidaire

2Source : France biométhane

A high-growth market

The growth of the sector is accelerating, its ambition is strong, and goals are high:

20% annual growth since 20163

€690 million in turnover at the end of 20173

10% renewable gas in the networks by 2030: target of the French Law on Energy Transition for Green Growth (LTECV)

3Source : ADEME

NGV/BioNGV expansion

In 2020, the objective of the new PPE (multi-annual energy programming) was to have 140 to 360 stations distributing NGV in 2023, and 330 to 840 stations by 2028.

A new AFNGV scenario plans to achieve 1,700 stations in 2035 (410 stations in 2023 and 910 in 2028) for an overall investment cost estimated at €1.2 billion.